Today we are going to look at the concept of deliberate markets when looking to trade. A deliberate market is one in which the price action is moving in a consistent and careful pattern. As trades are identified we need to consider the volatility that is currently happening with the market. Gold and silver can become volatile at times and especially when news is pending. Knowing what to look for to identify volatility can help us avoid times when the market may become less deliberate in the movements.

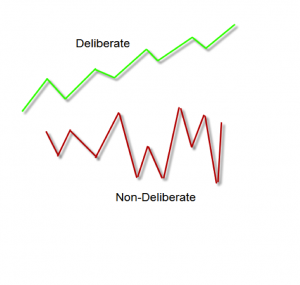

Take a look at the picture below which shows both a deliberate and a non-deliberate price action:

Notice that the deliberate movement consists of a pattern of higher highs and higher lows while the non-deliberate price action has a not distinct pattern of highs and lows. By avoiding these non-deliberate patterns and looking for the deliberate ones we can place our trades in the best situation for a profitable outcome. When trying to trade in a non-deliberate market we can anticipate seeing quick moves which can cause us to take quick losses on our trades.

Take a look at the chart below. This chart was taken from today’s price action before and after the ECB Press Conference. You will notice that the price action was extreme and quick in the moves that happened during this announcement. The initial swing was to the downside, followed by a large up move which ended up selling back off. This type of move can be expected but we cannot anticipate the direction or timing of the moves very quickly.

When looking to trade we must always look for the upcoming news that might impact our position. If the news is happening soon we may decide to hold off on entering the trade until after the announcement. If you are looking to take a trade in anticipation of a big volatile move then you need to make sure you are using good risk management rules. The only way to avoid the possible negative move is to avoid trading during these times. If you are determined to trade you can simply adjust your risk level down when determining your position size.

Now take a look at the 1-hour chart of Silver and you can see a more deliberate pattern that it was making. This deliberate pattern of higher highs (green arrows) and higher lows (red arrows) is what we want to see to trade. These deliberate movements can give us confidence that we are trading during the right market conditions.

We are not looking for perfection, just to trade during times where the market is less volatile and more deliberate. The charts will seldom look like the picture above where it is moving perfect but you should be able to eliminate when the market is too volatile. This can be done by knowing when the news is going to be reported and by looking at the charts to see the times when it is going through extreme moves.

Take some time to review your charts and become comfortable with identifying deliberate moving markets. Also, make sure you have access to an economic calendar from your broker. Doing these few things can help you avoid non-deliberate markets.