What are Japanese candlesticks and how can you use them? First, where and when did they originate? During the 17th century, Japanese rice traders developed candlestick charts to plot price movements. Japanese candlestick charts are often overshadowed by the use of various common technical indicators that are placed on the charts. However, the candlestick patterns themselves can be a powerful tool if we can learn to recognize a few of the common candlestick patterns. Traders can use candlestick patterns to better understand possible market sentiment.

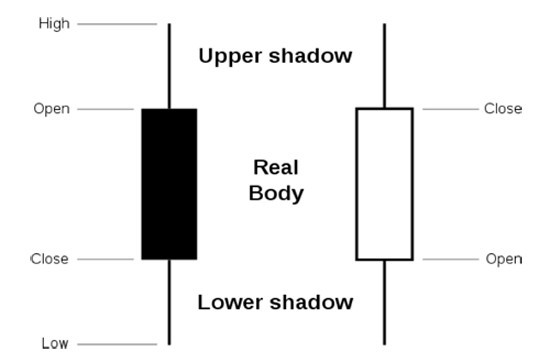

The individual candlesticks are simply graphical representations of price movements for a given period of time. They are formed by the open, high, low, and close of any trading instrument. Japanese Candlesticks are used on all tradeable markets, including stocks, futures, forex, etc.

If the opening price is above the closing price, then a solid candlestick is drawn, which is a down or bearish candle. If the closing price is above the opening price, then a “hollow” candlestick is drawn, which is a bullish candle. Each Candlestick is made up of two different parts – the first is the “filled” or “hollow” portion of the candle, which is known as the candle body and is the difference between the open and close prices for a specific time frame.

The second element of the candlesticks are the lines above and below the candle body, which are normally referred to as the wicks, and represent the high and low prices for that specific time frame. For example, in the diagram below, if the price closes lower for the time frame, a down, bearish, or “filled” candle is formed, like on the left candle below. If the price closes higher, then we have an up, bullish, or “hollow” candle, like the candle on the right side below.

Two common but powerful Candlestick Patterns to look for are:

Two common but powerful Candlestick Patterns to look for are:

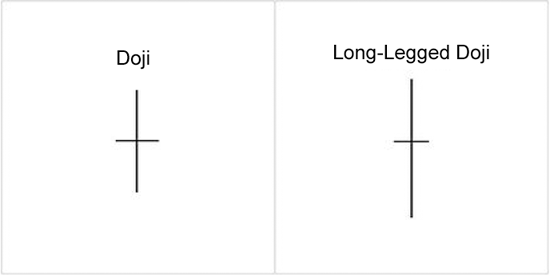

The Doji

One of the most popular candlestick patterns is the doji pattern. What is a doji? A doji is when the individual stock, or any other market instrument for that matter, opens, moves up or down throughout the market day, but closes at about the same price as the open. The lengths of the wicks (the high and low) can vary from short to long. The doji pattern indicates indecision in market direction between buyers and sellers. The long legged doji consists of a doji with longer wicks and indicates stronger indecision between the buyers and sellers.

Traders can use the indecision indicated by the doji pattern to identify a potential weakening of the current trend. This can often trigger a price reversal in the opposite direction.

Traders can use the indecision indicated by the doji pattern to identify a potential weakening of the current trend. This can often trigger a price reversal in the opposite direction.

Engulfing Candlestick Pattern

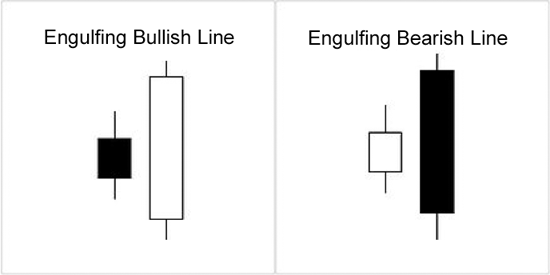

Another one of the basic patterns indicating uncertainty in the market and a potential direction change in the market is the engulfing pattern. Examples of bullish and bearish engulfing candles follow:

These engulfing candlestick patterns are a favorite pattern among candlestick traders because they are a good indicator of a possible market reversal. The pattern consists of two separate candles. The first candle is a narrow range candle that closes down. While the sellers are in control, being charted because volatility is low, the sellers are not very aggressive. The next day is a wider range candle that totally covers or fully “engulfs” the body of the previous day and closes near the top of the range. In effect, the buyers have overwhelmed the sellers. Buyers may be ready to take control and push the issue higher. Note in the current chart below of the EUR/USD 5 min chart, that the whole market sentiment reversed at the bullish engulfing candlestick formations. Also note that just before the bullish engulfing pattern, two dojis are also present, setting up market indecision first and then the engulfing pattern followed through on that market indecision and a change in momentum and trend occurred.

These engulfing candlestick patterns are a favorite pattern among candlestick traders because they are a good indicator of a possible market reversal. The pattern consists of two separate candles. The first candle is a narrow range candle that closes down. While the sellers are in control, being charted because volatility is low, the sellers are not very aggressive. The next day is a wider range candle that totally covers or fully “engulfs” the body of the previous day and closes near the top of the range. In effect, the buyers have overwhelmed the sellers. Buyers may be ready to take control and push the issue higher. Note in the current chart below of the EUR/USD 5 min chart, that the whole market sentiment reversed at the bullish engulfing candlestick formations. Also note that just before the bullish engulfing pattern, two dojis are also present, setting up market indecision first and then the engulfing pattern followed through on that market indecision and a change in momentum and trend occurred.

A bearish engulfing pattern would be just the opposite as the bullish engulfing pattern, indicating a change or reversal to the downside.

A bearish engulfing pattern would be just the opposite as the bullish engulfing pattern, indicating a change or reversal to the downside.

Conclusion

These two popular candlestick patterns, both dojis and engulfing patterns, can be used to help identify indecisive market sentiment and potential changes in direction. As illustrated, when both are present, there is an even stronger case to be made for a market reversal. Look for one of both of these patterns to help identify momentum price shifts.