Trading with the trend is one of the best ways to succeed. However, identifying a trend in the markets can be a bit tricky; trends start and stop, continue and reverse. Once a trend starts, it doesn’t go straight up or down, but will have areas of retracement or pull back. The very nature of the market forces of supply and demand makes sure that there are natural levels of profit taking in most market moves. One of the most important elements of successful trading is identifying these pullbacks and to understand if they are just temporary pauses, or if they are actually market reversals. This is where analysis of the price action comes in. We can use certain price patterns based on this price action to help determine if these pull backs are possible setups for an entry.

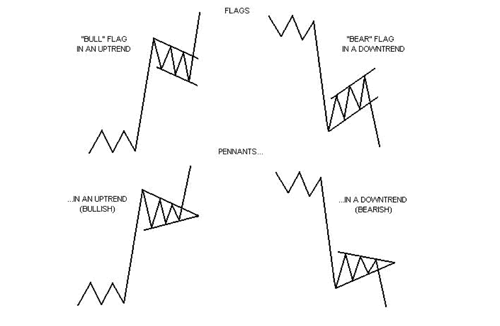

One type of price pattern we can use is a continuation pattern such as a Bull Flag or Bull Pennant for an uptrend market or Bear Flags and Bear Pennant for a downtrend market. These patterns help us to identify areas of continuation, looking at a pull back or a consolidation and resumption of previous trend after the pull back. Here are some examples of what these continuation patterns look like:

Flags and pennants can be generally categorized as continuation patterns. These price patterns usually show brief pauses in a strong trend. They are usually seen right after a larger quick move. The market will often pick up again in the same direction. Over time these continuation price patterns are very good at identifying potential entry points.

Bull flags are characterized by lower tops and lower bottoms, with the pattern slanting against the trend. But unlike wedges of a Bull Pennant, their support and resistance lines run parallel.

Bear flags are comprised of higher tops and higher bottoms. “Bear” flags generally slope against a strong down sloping trend.

Pennants are similar to flags but are not parallel and look very much like symmetrical triangles. Pennants are also generally smaller in size or volatility and duration than Flag patterns.

Here is a recent example of several bull flags on the AUDUSD Daily Chart:

Note in the graph above that after a move up, the Bull Flag is formed by the lower highs and lower lows in a pullback and once it broke above the flag it resumed the bullish uptrend and then another Bull Flag formed by more parallel lower highs and lower lows running against the uptrend, and once the pullback is “broken” the price breaks out and continues the previous up trend for a very positive gain. The best way to take advantage of this pattern is to set a “buy stop” entry order close to the top of the pullback so that if the trend resumes to that level you would be triggered into the trade to take advantage of the continuation. The same patterns apply to a bearish downtrend but in the reverse pattern and with a “sell stop” at the bottom for an entry order.

Take some time on the charts to look for these Flags and Pennant patterns to help identify good entry points as the current trend resumes.