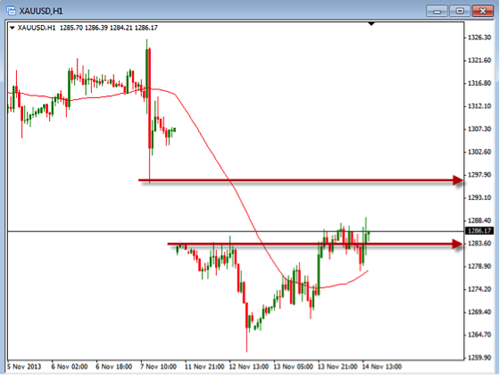

With the U.S. equity market again at all time records highs this week, there are already rumors of market bubbles and corrections, questions about the FED actions to ”taper” back QE3, etc. Times like these can certainly lead to fear, anxiety and often leads to our questioning our trading style and methods. Even sleepless nights can result. Sometimes we will alter or bend our rules during uncertain times – tightening up our stops is a common practice among newer traders; however, more seasoned traders understand that tightening up our stops during more volatile times can be the worst thing we can do and can further increase our losses. In fact, doing so can almost guarantee that you will lose on the trade. The thought may occur to us – if we are going to lose anyway, we want to lose less than we would have under normal circumstances. This kind of thinking can lead to a very negative trading psychology in which we may under-trade and miss perfectly good trading opportunities or may lead to chasing successful trades and entering trades too late. The important thing to remember is that we cannot totally eliminate our risk! The only way to absolutely eliminate market risk is to stop trading, but this will also totally eliminate any opportunity to be successful and make any trading profits as well.

The Key to Low Anxiety Trading is to reduce your EXPOSURE to the market.

The best way for a trader to reduce exposure in a volatile market is by reducing position size. Tightening our stops may reduce our potential exposure, but it also increases our probability of taking a loss. So if we are going to reduce our exposure by reducing our position size, and we normally define our risk as 2% per trade, then we may want to consider reducing our exposure per trade down to 1% or lower.

So, if we are feeling anxiety because of current market uncertainty, the best thing we can do is NOT to change our methods or system rules, but simply reduce our position size; therefore, reducing our exposure to the volatility. This will help us control the fear and anxiety that come from trading in times like we are currently experiencing.

Always use a stop loss and always quantify your risk before you make a trade. Nobody likes to take a loss, and I am no different; however, even under uncertain market conditions, like we are experiencing now, by managing your risk per trade, we can reduce our anxiety and still have good trading opportunities. Also, adhere to the “slow and steady wins the race” philosophy of investing and never “bet the farm” on a single trade because there really are no sure deals in life, only the possibility of success if we manage our risk and, thus, protect our trading accounts.

So, when the markets get crazy and uncertain, reduce your risk by reducing your position sizes, which will reduce your anxiety and go ahead– get a good night’s sleep!