Step 1: Identify the Trend

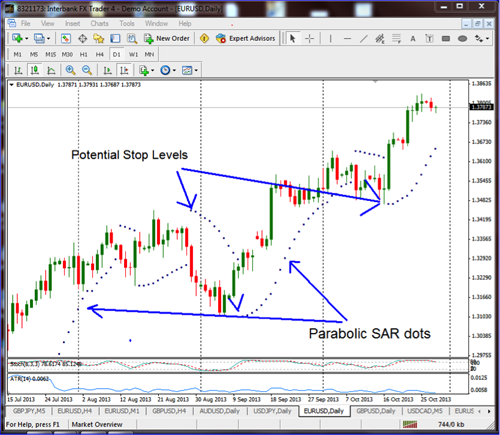

It is important to understand the current trend. Some traders refer to this as identifying or mapping the trend on the charts. Market trends come as long-term, intermediate-term and short-term trends. A simple and easy way to find the trend is get a longer term perspective by looking at the longer term charts, using either daily or weekly charts to help identify a good long term view. Now plot a 50 period simple moving average (SMA) on the chart. If the 50 SMA is moving up and the price action moves is above or below the 50 period SMA, you can determine that you are in an up (bullish) trend or if the price action on the chart is below the 50 period moving average and the 50 SMA is moving down for a confirmed down (bearish) trend.

Once we have identified a longer-term trend, we can then go to shorter-term charts, perhaps hourly charts to help us determine a view of the shorter-term trend. Once we have the trends identified, it is important to trade in the direction of the trend. This theory holds true even if trading very short term charts such as 5 or 15 minute charts. You will find that you will have better short-term trades even if they are in the direction of the combined longer-term trends on the higher time frame charts.

Step 2: Identify the Strength of the Trend

While the trend is important, you also need to have an idea of how strong the trend is, either up or down. One good way to determine the strength of the trend is to use the Technical Tool referred to as the ADX or Average Directional Movement index. The Average Directional Movement Index (ADX) line helps determine whether a market is in a strong or weaker trend, or no trend at all but simply trading sideways. It measures the degree of trend or direction in the market. A rising ADX line suggests the presence of a strong trend. A falling ADX line suggests the presence of a weaker trending market or the absence of a trend.

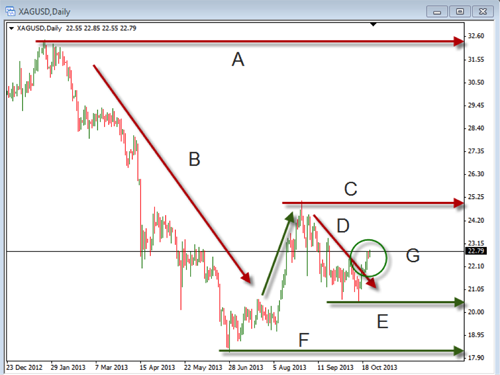

Step 3: Identify the Support and Resistance Levels on the Charts

On your chart, find the support and resistance levels. It is always best to buy the market long at a support level and to sell the market short at a good resistance level. The easiest way to identify these levels is by placing a trend line across the market highs to form a good resistance or market ceiling level and a trend line connecting the market lows to form a good support or market floor. Also, note that once a support resistance level has been broken, that level often becomes a new support or resistance level on the other side. In other words, if we have a price peak above the old resistance level, that same resistance level often becomes a new support level as the price “retraces”. The same is true if the price bar closes below a support level or floor, that old floor or support level often becomes a new resistance or ceiling. These support and resistance levels are important when determining if a trading channel exists and areas where there might be a bounce off of the top or bottom to identify a potential entry point.

Conclusion

As you trade and use these three steps to identify the direction of the trend, the strength of the trend and then identify good entry points, you will find that you will be making better momentum trades. Follow the price action with the moving averages and the support and resistance zones to help clarify the best trades.